fha loan colorado down payment

Even for an FHA loan with a higher down payment most lenders require a score of at least 540. Your FHA down payment can be as low as 3.

Colorado Down Payment Assistance Programs

FHA Loan Income Requirements Debt Guidelines You may be curious how much income is needed to qualify for an FHA loan.

. Meanwhile borrowers with credit scores between 500 and 579 can take this mortgage option with a 10 down payment. The FHA minimum credit score requirements are as low as 580 for a 965 percent loan and 500 for a 90. Low 35 Down Payment Requirements Credit Score Requirements as Low as 580.

The assistance funds come in the form of a zero-interest second mortgage with a 30-year term. 5 of loan. This is the loan that comes with 35 down payment if a borrower has a credit score of 580.

The more you pay upfront the smaller your loan. FHA loans are the 1 loan type in America. The rules became so strict that a large number of condos across the country would not qualify for an FHA loan.

DOWN PAYMENT ASSISTANCE MAY BE. FHA loans are available for many different types of properties. 500 for a 10 percent down payment 580 for a 35 percent down payment Maximum front-end debt-to-income ratio amount spent on monthly mortgage payments only 31 percent.

The USDA and VA also both allow 0 down payment loan options for qualifying borrowers. Youll pay an upfront mortgage premium UFMIP which normally amounts to 175 of your base loan amount. You can visit HUDs website to find the FHA loan limit in any county.

If you put down less than 10 youll pay FHA mortgage. Anchor Loan Amount. Calculate 2022 FHA Ceiling Loan Amount.

Borrowers have to pay an upfront mortgage insurance premium equal to 175 of the total loan amount regardless of the down payment amount. Annual MIP can vary from 045 percent to 105 percent depending on your loan amount loan term and down payment amount. Each FHA loan requires both an upfront premium of 175 percent of the.

All FHA loans require 175 percent of the loan amount as upfront MIP. Because of this lower down payment all FHA mortgage holders are required to pay into the FHA-run mortgage insurance fund. For many US borrowers FHA loans are the cheapest most-accessible low-down payment home loan.

Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. Funded by the CBC Mortgage Agency this program offers the ability to utilize an FHA-insured home loan by offering eligible applicants 35 of the purchase price to cover the down-payment. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify.

Find and compare mortgage rates. DOWN PAYMENT ASSISTANCE MAY BE. Average Home Sale Price in CO 1.

The FHA basic mortgage program is eligible for single family housing to multifamily housing. Duplex 2 Units A duplex is a property that consists of two attached homes. Jumbo Loan Limits.

FHA loans are the 1 loan type in America. For today September 12th 2022 the current average mortgage rate for a 30-year fixed-rate mortgage is 5668 the average rate for a 15-year fixed-rate mortgage is 4967 the average rate for a. 7 Loan options.

If you get a 30-year loan and make the FHAs minimum down payment of 35 percent your annual MIP would add 085 percent of the loan amount per year. Low 35 Down Payment Requirements Credit Score Requirements as Low as 580. HUD determines the FHA ceiling loan amount by using an initial loan amount and the ceiling amount.

Borrowers with a troubled credit history may have difficulty getting approved by conventional lenders. 5 mortgages that require no down payment or a small down. Maximum CO Home Buyer Grant 3.

Back in 2010 FHA changed its rules for offering mortgages on condo units. The pros and cons of paying off your mortgage early. This page covers the FHA loan income requirements for 2022.

The estimated monthly payment shown here does not include the FHA-required. Single Family Residence A one unit property that is not attached to any other units. Estimated monthly payment and APR assumes that the upfront mortgage insurance premium is financed into the loan amount.

The Pros of a Larger Down Payment. For FHA loans the minimum credit score for a loan with a 35 percent down payment with a credit score minimum of 600 from most lenders. FHA loan mortgage insurance is typically paid for the life of your loan unless you make a down payment of 10 or more in which case MIP comes off after 11 years.

Thankfully changes are here. Low 35 Down Payment Requirements Credit Score Requirements as Low as 580. This includes the current FHA guidelines related to income debt-to-income ratios and employment.

FHA loans allow you to put down as little as 35 if you have a credit score of 580 or better or 10 if your credit score is. Types of Properties You Can Finance with a FHA Loan. Average Credit Score in CO 2.

Down payment assistance programs in every state for 2022 August 2 2022 FHA mortgage insurance removal. However an individual lender may also impose more strict credit score limits as long as. That means you pay less in total interest costs over the life of the loan and you also benefit from lower monthly paymentsTo see how this works for yourself gather the numbers from any loan youre considering and plug.

FHA loans actually do not have a minimum income requirement nor are. Get rid of PMI or MIP January 28 2022 How to buy a house with bad credit. DOWN PAYMENT ASSISTANCE MAY BE.

Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. FHA loans are the 1 loan type in America. A bigger down payment helps you minimize borrowing.

647200X 65 420680 FHA 2022 Floor Loan Amount. This is the highest amount that any MSA can have as their Maximum FHA Loan amount for 2022 except for high-cost areas. With a 35.

A mortgage insurance premium MIP is a required payment for an FHA loan. 20 Down Payment in CO. An example is Denver County Colorado where the 2022 FHA loan limit is 684250.

Minimum credit score. Estimated monthly payment and APR calculation are based on a down payment of 35 and borrower-paid finance charges of 0862 of the base loan amount. With FHA backing you can often get approved with a low credit score and even a history of bankruptcy or foreclosure.

Minimum Down Payment in CO 3 21581. As of October 15 2019 FHA will.

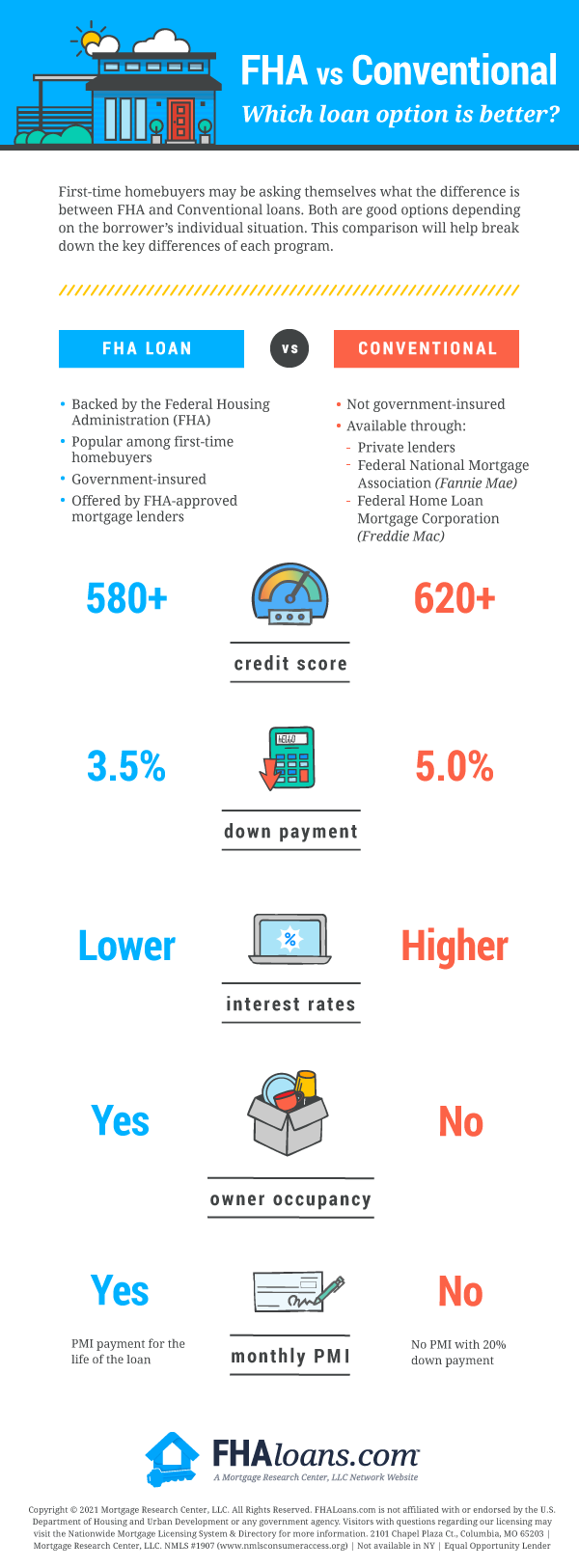

Fha Loans Vs Conventional Loans Pros And Cons Updated 2017

Fha 100 Down Payment Mortgage Hud Homes Fha Lenders

Colorado Fha Lenders Colorado Fha Loans 2022 Fha Lenders

Apex Mortgage Brokers Colorado Fha High Cost Areas

Fha Loan Down Payment Requirements

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

Fha Loan Requirements In 2022 A Complete Guide With Faqs Marketwatch

Fha Loan Closing Cost Calculator

Fha Vs Conventional Loan Is There A Difference

Colorado First Time Homebuyer Assistance Programs Bankrate

Fha Loan Colorado 2022 Fha Loan Limits Co Mortgageblog

Fha Down Payment Assistance Programs For 2022 Fha Lenders

Fha Loans Colorado Integrity First Financial

Fha Down Payment Assistance Programs For 2022 Fha Lenders

What Down Payment Is Needed For An Fha Loan Richmond American Homes

Fha Credit Requirements For 2022 Fha Lenders

Down Payment Assistance Home Loans Colorado Arizona Affordable Interest Mortgage